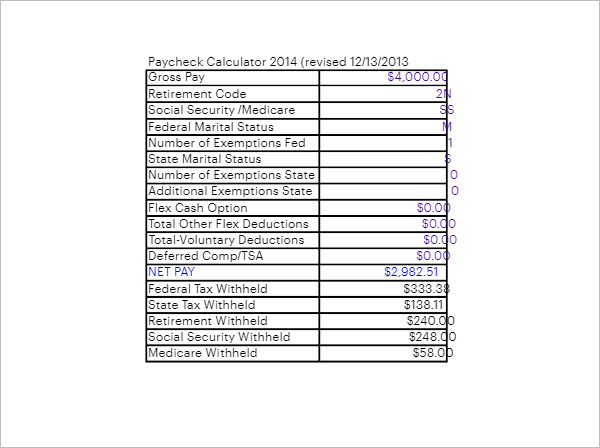

19+ paycheck calculator nd

Back to Payroll Calculator Menu 2013 North Dakota Paycheck Calculator - North Dakota Payroll Calculators - Use as often as you need its free. Ad Compare 5 Best Payroll Services Find the Best Rates.

16 19 Bursary Fund Application Form Guidance Notes Bhasvic

Area of kite calculator.

. North Dakota Paycheck Calculator. This free easy to use payroll calculator will calculate your take home pay. North Dakota levies a progressive state income tax with five brackets based on income level.

Calculating your North Dakota state income tax is similar to the steps we listed on our Federal paycheck. How to calculate annual income. For the Social Security tax withhold 62 of each employees taxable wages until they hit their wage base for the year.

North Dakota Hourly Paycheck Calculator. The state income tax rate in North Dakota is progressive and ranges from 11 to 29 while federal income tax rates range from 10 to 37 depending on your income. It is not a substitute for the.

North Dakota Hourly Paycheck and Payroll Calculator. Supports hourly salary income and multiple pay. Payroll pay salary pay check.

For example if an employee earns 1500. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The 2022 wage base is 147000.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for. Simpson diversity index calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

Discover a wealth of knowledge to help you tackle payroll HR and benefits and compliance. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. North Dakota Hourly Payroll Calculator - ND Paycheck Calculator.

COVID-19 Employer Toolkit Diversity Equity and Inclusion Toolkit. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for North Dakota residents only. Make Your Payroll Effortless and Focus on What really Matters.

Calculate your North Dakota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Dakota. The state is notable for its low income tax rates which range. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Need help calculating paychecks. Important Note on Calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Overview of North Dakota Taxes. The North Dakota Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. Take home pay is calculated based on hourly pay rates that you enter along with the pertinent Federal State and local W-4.

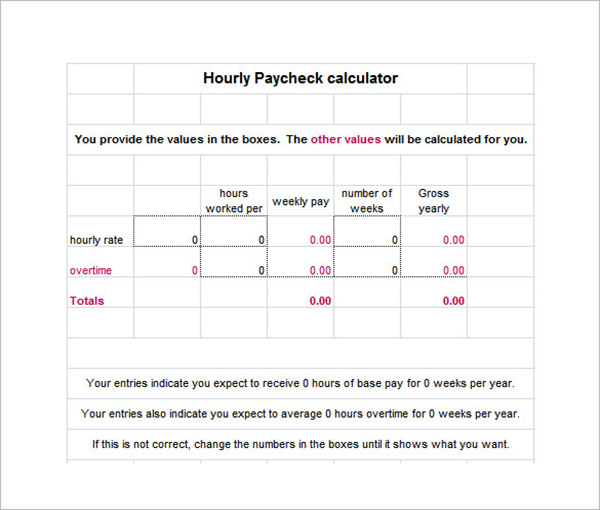

12 Salary Paycheck Calculator Templates Free Pdf Doc Excel Formats

Odds Calculator Bet Calculators Sportsbook Review

Symmetry Software Offers Dual Scenario Calculators To Aid In Comparing Take Home Pay For Varying Deductions And Benefits

North Dakota Hourly Paycheck Calculator Gusto

Enterprise Value Calculation Wacc Formula Terminal Value

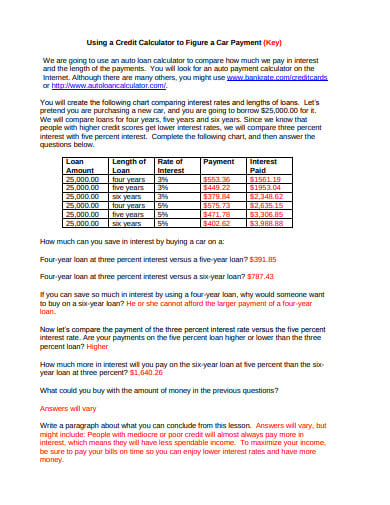

10 Loan Calculator Templates In Pdf Doc Free Premium Templates

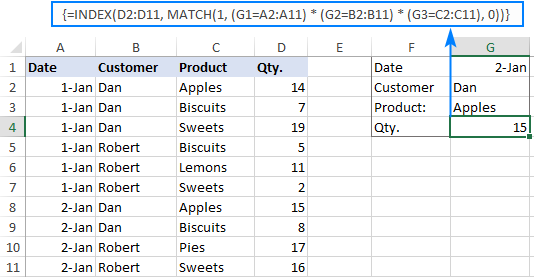

Advanced Vlookup In Excel Multiple Double Nested

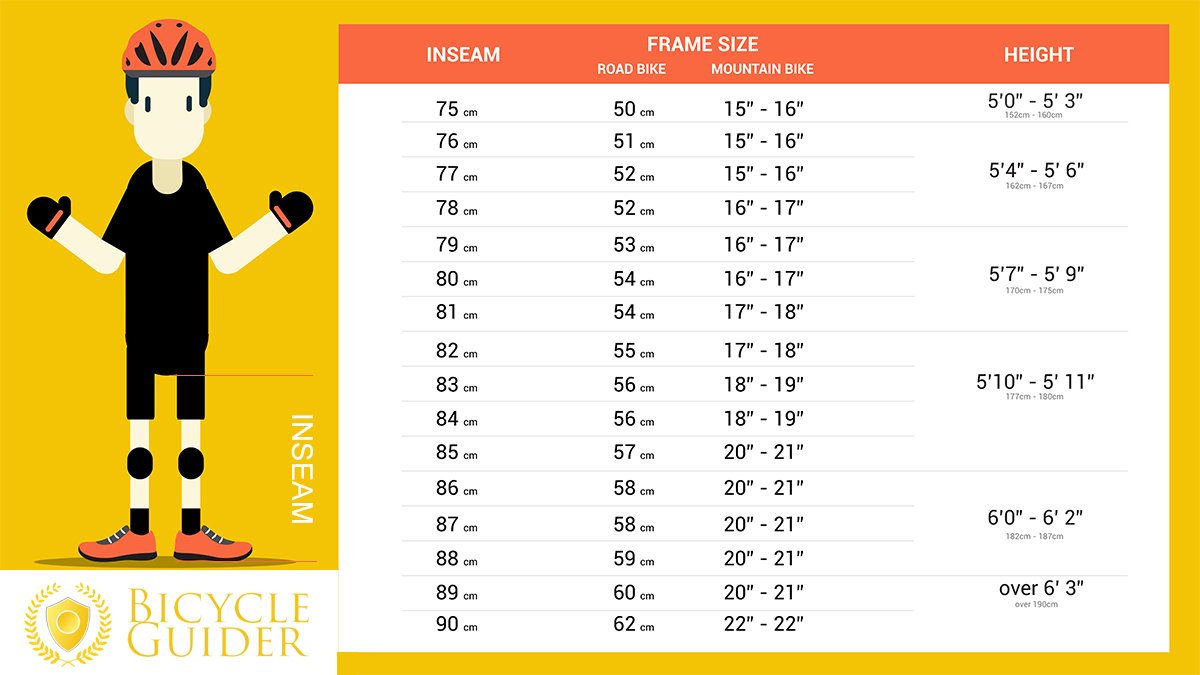

Bike Size Chart How To Choose Right Bicycle 7 Methods

12 Salary Paycheck Calculator Templates Free Pdf Doc Excel Formats

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

North Dakota Hourly Paycheck Calculator Gusto

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Pdf Multiple Ionization Of Ar Kr And Xe In A Superstrong Laser Field

Paycheck Calculator Take Home Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Pdf Why Are Households That Report The Lowest Incomes So Well Off